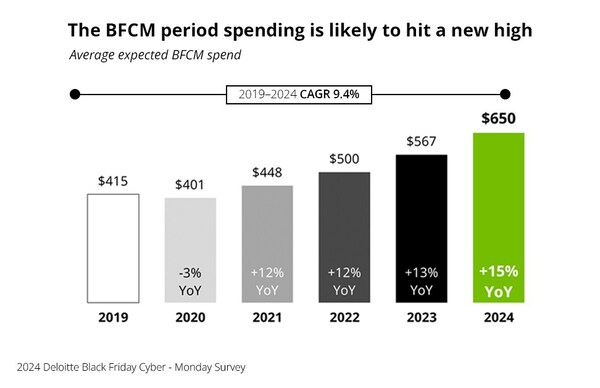

Consumers are expecting to spend a record average of $650 during the Black Friday-Cyber Monday (BFCM) shopping period—from Thursday, Nov. 28 to Monday, Dec. 2—up 15% from last year, according to a new survey from Deloitte.

The Big Four accounting firm polled 1,200 consumers between Oct. 16 and Oct. 24 for its 2024 Black Friday-Cyber Monday Survey, which examines what retailers can expect from shoppers between Thanksgiving and Cyber Monday. This year, even as consumers plan to spend more, getting more bang for their buck appears to be their top shopping strategy.

Nearly half (45%) of consumers surveyed say they have already experienced higher prices for holiday items this season, and almost a third (32%) of respondents say retailers are discounting less. As a result, shoppers plan to spend the majority of their holiday budgets during the promotional week to get more for less.

Key findings of the survey include:

- 80% of those surveyed plan to shop during BFCM. While participation is expected to be similar to 2023, spending is expected to reach a new high of $650, up 15% from 2023.

- Consumers plan to spend more than half (56%) of their holiday budgets during the BFCM period, up from 47% in 2023, further underscoring the importance of the holiday week for seasonal shoppers.

- All income groups plan to increase their spending during BFCM, but those making less than $50,000 and those making $200,000 or more plan to spend 22% and 20% more, respectively, year over year.

- BFCM spending has accelerated since 2021; the three-year compounded annual growth rate (CAGR) from 2021 to 2024 for BFCM spend is 13.2% and even higher among Gen Z shoppers (25%).

- Respondents indicate they prefer to shop at online-only retailers (69%) and mass merchants (65%) during the BFCM period as they seek value. This year, online-only retailers took the top spot for the first time as the preferred retail format among consumers surveyed.

- To stretch their BFCM budgets, 53% of respondents plan to use credit cards, up from 35% in 2023, and 29% will use buy now, pay later (BNPL) services. Overall financing and credit card usage are highest among millennials (72% for each).

“This year we have a shorter holiday shopping season with the late Thanksgiving. Combined with a deal-focused consumer, we can expect to see holiday shoppers spend big during Black Friday-Cyber Monday promotions as they seek to close out their holiday shopping lists in a shorter timeframe,” Brian McCarthy, a principal at Deloitte Consulting, said in a statement. “We continue to see the week evolve as a hybrid event, but online retailers are taking the top spot for the preferred format for the first time among those surveyed. This reinforces the importance of offering a consistent omnichannel experience to draw in consumers whether they plan to shop in-store, online, or both.”

Despite heightened interest in October promotional events, only a third (32%) of those who shopped during that time period say it offered the best deals, compared to 49% who said the same in 2023, opening up an opportunity for retailers to attract value-seeking shoppers during the BFCM week. This is compounded by nearly half (47%) of respondents who say the best deals of the season are on Black Friday.

The Deloitte survey also revealed:

- Two-thirds (66%) of shoppers surveyed plan to shop on Black Friday, driving participation back up to prepandemic levels and recovering from a low of 56% in 2021.

- Surveyed consumers plan to spend $195 online and $150 in-store on Black Friday on average.

- Expected online spending on Black Friday is growing faster than in store. Overall, the five-year CAGR (2019-2024) for online shopping is 10%, compared to 3% for in store.

- Shoppers are filling their online shopping carts as doorbuster deals slowly lose appeal. This year, only a quarter of consumers surveyed plan to shop in-store to take advantage of doorbusters.

- Six in 10 (58%) looking for deals say they have already put items in their online cart to purchase during BFCM, four in 10 (37%) will only buy items during BFCM that are at least half off, and a third (34%) will likely make a BFCM purchase while at work.

Consumers surveyed plan to capitalize on discounted gifts and spend in four categories this year during the Thanksgiving week versus three in 2023:

- All gift categories are expected to see increased participation as consumers seek discounts. BFCM survey respondents plan to purchase clothing and accessories (77%), electronics and accessories (57%), and toys and hobbies (54%).

- Health & wellness and pet products are expected to see double-digit participation—34% and 29%, respectively.

- About one-half (48%) of surveyed consumers plan to take advantage of discounts to buy a gift for themselves and spend an average of $280.

“Consumers are relying on this week to stretch their dollars. Black Friday-Cyber Monday is all about value; this year, all income levels and age groups are looking for deals,” said Stephen Rogers, managing director of the Deloitte Insights Consumer Industry Center. “Holiday shoppers expect to spend more than half their holiday budget (56%) this week, and we expect to see an even greater share of spending among Gen Z and millennials seeking deals on gifts for loved ones and for themselves.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs